X-Strategy Services

Categories

“Step-by-Step Guide: How to Choose the Right Insurance Agent Website Builder”

Introduction

A. Importance of a professional website for insurance agents

In today’s digital age, having a professional website is crucial for insurance agents. It serves as an online storefront and a powerful marketing tool that allows agents to showcase their services, expertise, and build credibility with potential clients. A well-designed website instils trust and professionalism, giving agents a competitive edge in the industry.

B. Role of website builders in creating an effective online presence

Website builders play a vital role in simplifying the process of creating a professional website for insurance agents. These platforms offer user-friendly interfaces and intuitive tools that require little to no coding knowledge. With website builders, agents can choose from a wide range of templates, customise their site to align with their brand, and easily add essential features such as contact forms, quote request forms, and blog sections. Website builders streamline the website development process, allowing agents to focus on growing their business and serving their clients effectively.

II. Determine Your Website Needs

A. Identifying your target audience and goals

Before choosing an insurance agent website builder, it’s essential to clearly identify your target audience and goals. Consider the demographics and preferences of your ideal clients. Are you targeting individuals, families, or businesses? Understanding your audience will help you create a website that resonates with them and meets their specific needs.

Additionally, define your goals for the website. Are you looking to generate leads, provide information, or establish yourself as a thought leader in the industry? Defining your goals will guide the selection of features and functionalities that align with your objectives.

B. Understanding the features and functionalities required

Once you have identified your target audience and goals, it’s important to determine the specific features and functionalities you need on your website. Some essential features for insurance agent websites include:

1. Contact Forms: To allow visitors to easily reach out for inquiries or quotes.

2. Quote Request Forms: To enable visitors to request insurance quotes directly from your website.

3. Blog Section: To share informative articles, industry news, and insights to establish credibility and engage visitors.

4. Testimonials: To showcase positive feedback from satisfied clients, building trust and credibility.

5. Integration with CRM Systems: To streamline lead management and customer relationship management processes.

6. Mobile Responsiveness: Ensuring your website looks and functions well on mobile devices.

7. Social Media Integration: To connect your website with your social media profiles and enable easy sharing of content.

8. SEO Tools: To optimise your website for search engines and improve its visibility.

By understanding the specific features and functionalities required, you can narrow down your options and select a website builder that provides the necessary tools to meet your needs effectively.

III. Research Different Website Builders

A. Popular website builder options for insurance agents

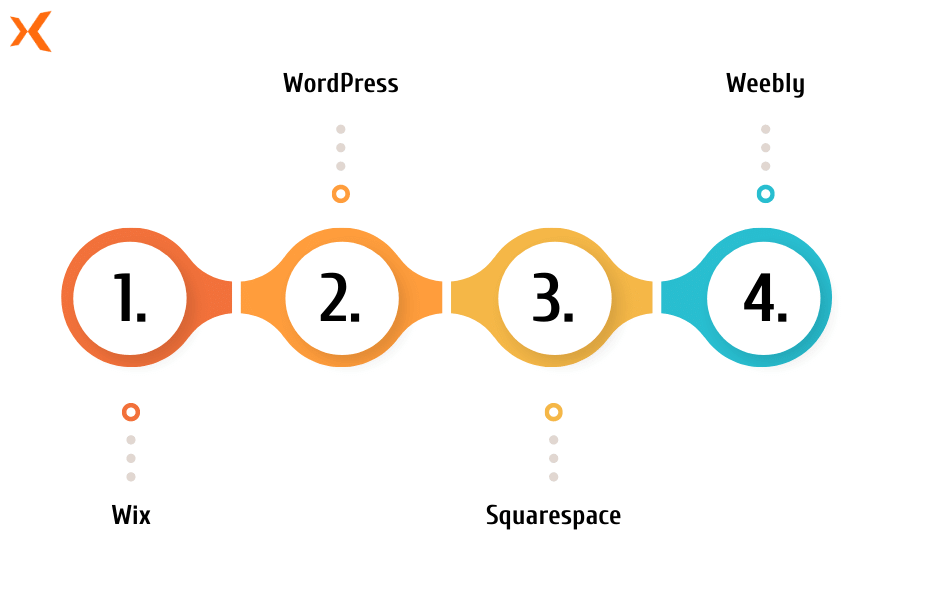

When researching website builders for insurance agents, several popular options stand out in the market. Some of these include:

1. Wix: Wix offers a user-friendly drag-and-drop interface and a wide selection of templates. It provides a range of features suitable for insurance agents, including contact forms, appointment scheduling, and integration with popular CRM systems.

2. WordPress: WordPress is a versatile platform that offers extensive customization options and a vast library of plugins. It is highly flexible and allows for more advanced website development. WordPress also offers numerous insurance-focused themes and plugins.

3. Squarespace: Squarespace is known for its sleek and modern templates that provide a professional look. It offers a range of features such as contact forms, appointment scheduling, e-commerce integration, and analytics.

4. Weebly: Weebly is a user-friendly website builder with intuitive drag-and-drop functionality. It offers a good selection of templates and provides features such as contact forms, blogging capabilities, and integration with popular marketing tools.

B. Comparing the key features and pricing plans

When comparing different website builders, it’s important to consider their key features and pricing plans. Look for features that align with your website needs, such as customization options, e-commerce capabilities, SEO tools, and integration possibilities with CRM systems or other third-party tools.

Pay attention to the pricing plans offered by each website builder, considering factors like monthly or annual costs, storage and bandwidth limitations, and any additional fees for premium features or domain registration.

Comparing the key features and pricing plans of different website builders will help you narrow down your options and find the builder that offers the best combination of features, flexibility, and affordability for your insurance agent website.

IV. Consider Ease of Use and Customization

A. User-friendly interface and drag-and-drop functionality

When choosing an insurance agent website builder, it’s important to consider the ease of use and the availability of a user-friendly interface. Look for a builder that offers a straightforward and intuitive platform, allowing you to create and manage your website without the need for extensive technical knowledge or coding skills.

One aspect to consider is the availability of drag-and-drop functionality, which enables you to easily move and arrange elements on your website. This feature simplifies the process of designing and organising your site’s layout, making it more efficient and user-friendly.

B. Customization options for branding and personalization

Another crucial factor to consider is the level of customization options available with the website builder. Look for a builder that allows you to personalise your website to align with your brand identity and unique requirements as an insurance agent.

Consider the availability of customizable templates, colour schemes, fonts, and the ability to add your logo and other branding elements. The more flexibility you have in customising the appearance and layout of your website, the better you can create a distinct and professional online presence that resonates with your target audience.

Additionally, check if the website builder offers advanced customization options, such as the ability to edit the website’s CSS or HTML code. This level of customization allows you to have more control over the design and functionality of your website, catering to specific preferences and requirements.

By considering the ease of use and customization options, you can select an insurance agent website builder that provides a user-friendly experience while allowing you to create a unique and visually appealing website that represents your brand effectively.

V. Evaluate Design Templates

A. Variety and quality of pre-designed templates

When choosing an insurance agent website builder, it’s important to assess the variety and quality of pre-designed templates available. Look for a builder that offers a wide range of templates specifically designed for insurance agents or related industries. These templates can provide a head start in designing your website and ensure a professional and visually appealing look.

Evaluate the aesthetics, layouts, and functionality of the templates. Consider if they align with your brand and if they provide the necessary sections and features for your website, such as contact forms, service descriptions, or client testimonials. The more diverse and high-quality the template options, the better you can find a design that suits your preferences and meets your specific needs.

B. Responsive and mobile-friendly designs

In today’s mobile-centric world, having a responsive and mobile-friendly website is crucial. Ensure that the website builder offers templates that are optimised for mobile devices. Responsive designs automatically adjust and adapt to different screen sizes, providing an optimal viewing experience for visitors accessing your site from smartphones or tablets.

Test the mobile responsiveness of the templates provided by the builder to ensure they display well and maintain functionality on various devices. A mobile-friendly website not only enhances the user experience but also contributes to better search engine rankings, as search engines prioritise mobile-friendly websites in their results.

Share your idea or requirement with our experts.

VI. Assess Integration Capabilities

A. Integration with CRM and lead management systems

Effective integration with customer relationship management (CRM) and lead management systems can significantly enhance your efficiency as an insurance agent. Check if the website builder offers seamless integration with popular CRM platforms or provides built-in CRM functionalities. This integration allows you to capture leads from your website directly into your CRM system, streamline follow-ups, and track customer interactions efficiently.

B. Compatibility with third-party tools and plugins

Consider the compatibility of the website builder with third-party tools and plugins. Assess if the builder allows easy integration with essential tools like email marketing services, analytics platforms, or appointment scheduling systems. Compatibility with these tools expands the functionality of your website and allows you to leverage additional features and services to enhance your online presence and streamline your business operations.

By evaluating the design templates for variety and quality, as well as assessing integration capabilities, you can choose an insurance agent website builder that offers visually appealing templates and integrates seamlessly with the necessary tools to optimize your website’s performance and user experience.

VII. Review SEO and Marketing Features

A. Search engine optimization (SEO) tools and plugins

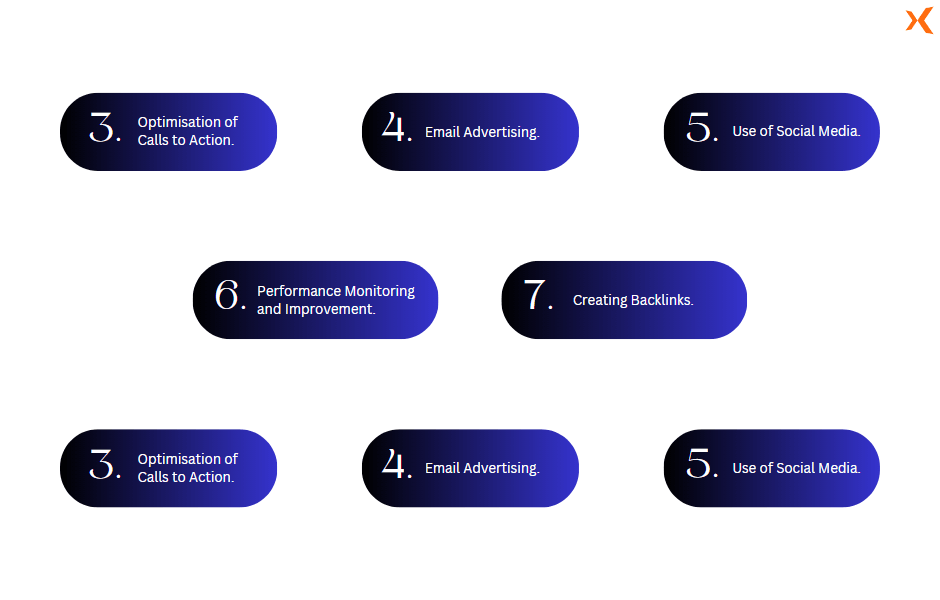

When selecting an insurance agent website builder, it’s essential to consider the availability of search engine optimization (SEO) tools and plugins. These tools help improve your website’s visibility in search engine results, driving organic traffic to your site.

Look for a website builder that offers features such as customizable meta tags, XML sitemap generation, and the ability to optimise page titles, headings, and image alt tags. These SEO-friendly features enable you to optimise your website’s content for relevant keywords and improve its ranking on search engine result pages (SERPs).

Additionally, consider if the website builder provides analytics and reporting features to track your website’s SEO performance. Access to data such as keyword rankings, organic traffic, and user behaviour can help you identify areas for improvement and refine your SEO strategies.

B. Marketing features like email marketing and social media integration

Effective marketing is crucial for the success of your insurance agent website. Assess the marketing features offered by the website builder, such as email marketing integration and social media integration.

Email marketing integration allows you to capture visitor information and build a subscriber list, enabling you to send targeted email campaigns and nurture leads. Look for website builders that offer built-in email marketing tools or seamless integration with popular email marketing services.

Social media integration is another important marketing feature to consider. Check if the website builder allows you to easily integrate your social media profiles with your website. This integration enables visitors to share your content on social media platforms, increasing brand visibility and driving engagement.

Furthermore, assess if the website builder provides features for adding social media sharing buttons, allowing visitors to easily share your website’s content on their own social media accounts. This can help amplify your reach and attract a wider audience.

By reviewing the SEO and marketing features of different website builders, you can choose a platform that offers robust tools and functionalities to optimize your website for search engines, as well as effectively promote your insurance services through various marketing channels.

VIII. Check Technical Support and Resources

A. Availability of customer support and response times

When choosing an insurance agent website builder, it’s important to consider the availability of customer support and the response times provided by the builder. Look for a website builder that offers responsive and reliable customer support channels, such as live chat, email, or phone support.

Check the hours of operation for customer support and assess their response times. Prompt and helpful support can be crucial when you encounter technical issues or have questions regarding the website builder’s functionalities. Consider reading user reviews or testimonials to gauge the quality of customer support provided by the builder.

B. Access to tutorials, documentation, and community forums

In addition to customer support, assess the availability of tutorials, documentation, and community forums provided by the website builder. Look for a builder that offers comprehensive resources, including video tutorials, step-by-step guides, and knowledge bases.

These resources can be valuable references for learning how to use the website builder effectively and troubleshoot common issues independently. Community forums or user communities can provide an additional support network where you can learn from other users, ask questions, and share experiences.

IX. Consider Scalability and Future Growth

A. Flexibility to accommodate business growth and expansion

As an insurance agent, it’s important to consider the scalability of the website builder. Evaluate whether the builder allows you to easily scale your website as your business grows. Consider factors such as the ability to add new pages, expand functionality, or accommodate increased traffic.

Choose a website builder that offers flexibility and room for customization, enabling you to adapt your website to changing business needs and evolving market trends. Scalability ensures that your website can support your business growth and accommodate future requirements.

B. Upgrading options and additional features

Assess the upgrading options and availability of additional features provided by the website builder. As your insurance agency expands, you may require advanced functionalities or premium features to enhance your website’s capabilities.

Consider if the website builder offers different subscription plans that allow you to access additional features as needed. Check for options such as e-commerce capabilities, advanced analytics, or integrations with more sophisticated CRM systems. Upgrading options ensure that your website can keep up with your evolving business needs and provide a seamless user experience.

By checking the technical support and resources available and considering the scalability and upgrading options, you can choose an insurance agent website builder that provides reliable support, access to helpful resources, and the flexibility to grow and adapt your website as your business expands.

X. Analyse Pricing and Cost

A. Subscription plans and pricing structures

When evaluating an insurance agent website builder, it’s crucial to analyse the available subscription plans and pricing structures. Take a close look at the features and resources included in each plan and consider how they align with your website needs and budget.

Compare the pricing models, such as monthly or annual subscriptions, and assess if there are any discounts or promotional offers available. Pay attention to factors like storage limits, bandwidth restrictions, and any additional fees for premium features or add-ons. Understanding the pricing structure will help you determine the affordability and value of the website builder.

B. Calculating the cost-to-value ratio

While considering pricing, it’s important to calculate the cost-to-value ratio of the website builder. Determine if the features, functionalities, and customer support provided by the builder justify the cost. Analyse how the website builder’s offerings align with your business goals and the potential return on investment (ROI) you expect to gain from your website.

Consider the long-term benefits and savings that the website builder can provide. A slightly higher initial investment may be worthwhile if it offers advanced features, scalability, and reliable technical support that can contribute to your business’s success in the long run.

XI. Read User Reviews and Testimonials

A. Gathering feedback from current users

Reading user reviews and testimonials can provide valuable insights into the experiences of current users of the website builder. Look for reviews on reliable platforms, industry forums, or social media groups. Pay attention to feedback related to ease of use, customer support, performance, and overall satisfaction.

User reviews can offer real-world perspectives on the website builder’s strengths and weaknesses, helping you make an informed decision based on the experiences of others in the insurance industry.

B. Considering the overall reputation and satisfaction ratings

Consider the overall reputation and satisfaction ratings of the website builder. Look for information on the builder’s track record, industry recognition, and customer satisfaction surveys. A website builder with a solid reputation and high satisfaction ratings is more likely to provide a reliable and satisfactory experience.

Take into account the consensus among users and industry experts regarding the builder’s performance, features, and customer support. This information can guide your decision-making process and provide additional assurance about the website builder’s reliability and quality.

By analysing pricing and cost, as well as reading user reviews and testimonials, you can assess the financial feasibility and reputation of the insurance agent website builder. This information will help you make an informed decision and choose a builder that offers the right balance of affordability, value, and user satisfaction for your specific needs.

XII. Make an Informed Decision

A. Creating a shortlist of potential website builders

After conducting thorough research and considering various factors, create a shortlist of potential insurance agent website builders that meet your requirements and preferences. Narrow down your options based on criteria such as user-friendliness, customization options, integration capabilities, SEO features, customer support, and pricing.

B. Weighing the pros and cons before finalising

Before making a final decision, carefully weigh the pros and cons of each shortlisted website builder. Consider factors such as ease of use, design templates, scalability, marketing features, technical support, pricing, and user feedback. Compare the strengths and weaknesses of each builder and evaluate how well they align with your specific needs and goals as an insurance agent.

XII. Make an Informed Decision

A. Importance of choosing the right insurance agent website builder

Selecting the right insurance agent website builder is crucial for establishing a professional online presence and effectively promoting your insurance services. A well-designed and functional website can attract and engage potential clients, enhance your credibility, and contribute to the growth of your insurance business. By choosing a suitable website builder, you can create a visually appealing, user-friendly, and feature-rich website that meets the unique requirements of your insurance agency.

B. Final tips and recommendations for a successful selection process

To ensure a successful selection process, consider the following tips:

- Clearly define your website needs and goals as an insurance agent.

- Conduct thorough research on different website builders and compare their features.

- Assess ease of use, customization options, integration capabilities, and marketing features.

- Consider scalability and the availability of upgrading options.

- Evaluate pricing and calculate the cost-to-value ratio.

- Read user reviews and testimonials to gather feedback from current users.

- Pay attention to the reputation and overall satisfaction ratings of the website builder.

- Create a shortlist of potential builders and carefully weigh their pros and cons.

- Seek assistance from customer support and explore available resources for guidance.

- Make an informed decision based on your specific needs, budget, and preferences.

By following these recommendations, you can confidently choose the right insurance agent website builder that empowers you to create a compelling online presence and achieve your business objectives.